Despite the turbulence created in the markets as a result of COVID-19, Granite Peak capitalized on opportunities on behalf of our clients throughout 2020 and 2021. Throughout the pandemic, Granite Peak remained active across the real estate investment landscape, successfully executing over $130 million in acquisitions, dispositions, and financings across various property types and markets.

As COVID-19 created uncertainty throughout the real estate markets, particularly in the retail and office asset class, Granite Peak capitalized on the opportunity to acquire several single-tenant retail properties and institutional flex properties with a credit-rated tenant roster that feature very attractive cash flow characteristics while providing significant downside protection, minimal management responsibility, and additional value-add opportunities in the future.

The financing markets provided additional opportunity during the pandemic, as Granite Peak recapitalized a Colorado multifamily asset to capture a full-term, fixed, interest-only loan that significantly increased cash flow and provided our client with the ability to finance the acquisition of two additional properties. Granite Peak also secured exceptional acquisition financing for the purchase of an institutional-quality flex property in Phoenix, which included prepayment flexibility and full-term, interest-only payments, resulting in significantly higher distributable cash flow for ownership. Granite Peak also remained active in dispositions, driven by the continued rise of e-commerce. Industrial real estate emerged from the pandemic as one of the most attractive asset classes. Beginning in early 2020, industrial land values in the South Bay submarket of Los Angeles surpassed land values for office properties for the first time, driven even higher by the explosive growth of e-commerce during the COVID-19 pandemic. These dynamics in the submarket created a unique opportunity for Granite Peak to capitalize on the underlying land value for future redevelopment into industrial use of one of our client’s primarily office-use assets. As a result, Granite Peak negotiated an off-market sale to the one of the leading industrial real estate owner/developers at near-record land values, far surpassing the asset’s value as a leased investment property.

Recent Acquisition Activity

265,000 SF Flex Office Asset – Phoenix, AZ

In November 2021, a client of Granite Peak acquired a 100% leased, 4-building, 265,000 square foot flex office property in central Phoenix’s prestigious Cotton Center. The property’s tenant roster features blue-chip billion-dollar tenants, which is enhanced by an attractive lease expiration schedule that provides for additional long-term value-add opportunities while minimizing downside risk. The Phoenix property further provides downside protection as a conversion to warehouse industrial space provided by the single-story, concrete tilt-up construction featuring 25’-28’ ceiling heights.

The large floor plate, single-story nature of the property provided ownership with an opportunity to capitalize on the rise of suburban office that has emerged as a result of the pandemic. Granite Peak recognized the increasing need for flexible workspace, featuring additional space for collaboration and more square footage per employee compared to traditional CBD office in order to fulfill the needs of the evolving work environment. The asset has already benefited from this reordering of the way we work as evidenced by the relocation of Fortune 500 credit tenants from CBD high-rise office product to the property and the Cotton Center, which remains one of the most prestigious business parks in metro Phoenix. Secured by the credit-rated and long-term “stickiness” of the tenancy, Granite Peak capitalized on the opportunity to acquire an institutional-quality flex asset at a very attractive entry point, with future upside as a result of significant value-add opportunities in a market poised for continued economic growth.

Bed Bath & Beyond and Cost Plus – Hawthorne/Manhattan Beach, CA

In early 2020, Granite Peak acquired the 40,500 square foot Bed Bath & Beyond within the Hawthorne Gateway Shopping Center, the dominant regional center anchored by a very high-volume Costco. The demographics of the coastal, West Los Angeles market includes the affluent communities of Manhattan Beach, Hermosa Beach, Redondo Beach and El Segundo and feature vibrant employment opportunities, as well as strong population and income growth. In addition, the property features excellent drive-by traffic due to its location on the Rosecrans corridor which runs from the San Diego (405) Freeway to the beach communities of Manhattan Beach and El Segundo.

Immediately following the close of the Bed Bath & Beyond acquisition, Granite Peak approached the previous owner with an off-market offer to purchase the newly constructed (but not yet opened) 24,000 square foot Cost Plus property in the same center. Granite Peak targeted both investments due to the attractive cash flow yield on the current income combined with the lower risk and longer-term investment stability provided by the in-place leases. In addition, the below market rents provided for downside protection with additional upside appreciation in the future. The acquisitions provided the client with additional flexibility to realize a future value-add opportunity if the space could be re-leased to other tenants with a higher credit rating, who are already identified, and at higher rent.

These retail acquisitions were a result of an exchange out of multifamily assets in the SF Bay Area at a 4% cap rate. The new retail buildings on long-term leases were acquired at a 5.5% cap rate, resulting in significantly increased yield on the client’s equity with far less management and maintenance risk.

Starbucks – Tempe, AZ

In early 2020, Granite Peak acquired the Starbucks in Tempe, Arizona. The property is leased to Starbucks on a net lease at below-market rents providing for lower risk and longer-term investment stability. The high-income demographic of Tempe is characterized by growing employment, population, and incomes provide a vibrant submarket for consumer services such as Starbucks, with potential for further appreciation in rents and property values. Additionally, the investment provides a higher return than the typically low-4% returns on other similar investment properties in similar locations, while the property’s Arizona location provides the investor further diversification away from a concentration of investments in California.

Jiffy Lube – Denver, CO

Granite Peak acquired Jiffy Lube in Denver, Colorado in 2020. The property is leased to a nationally known tenant on a 20-year net lease at below-market rents, providing for longer-term investment stability and future value creation. The Green Valley neighborhood of North Denver features strong employment growth, as well and growing population and incomes. Similar to the Starbucks investment in Tempe, the Jiffy Lube investment provides a higher return than the typically low-4% returns on other similar investment properties in similar locations, while the property’s Colorado location provides the investor additional diversity away from a concentration of investments in California.

Caliber Collision – Charlotte, NC

Granite Peak acquired the newly constructed single-tenant Caliber Collision in Charlotte, NC in November 2021 on behalf of a long-term client. The 15-year absolute net lease features no landlord responsibilities while also including heathy rent increases to protect the investment in an increasingly inflationary environment. The auto collision industry is marked by rapid consolidation from institutional investors, which is driving cap rates lower and prices higher across many markets. Granite Peak capitalized on the opportunity to acquire the asset at a lower entry price and higher yield than many similar investment properties in the region, which has resulted in significant value creation in the asset since acquisition. This was the second acquisition of a Caliber Collision for Granite Peak, with the first one located in Broomfield, Colorado. Granite Peak identified Charlotte as an attractive growth market, which is further enhanced by the asset’s positioning along a major traffic corridor surrounded by a densely populated, high-income suburb.

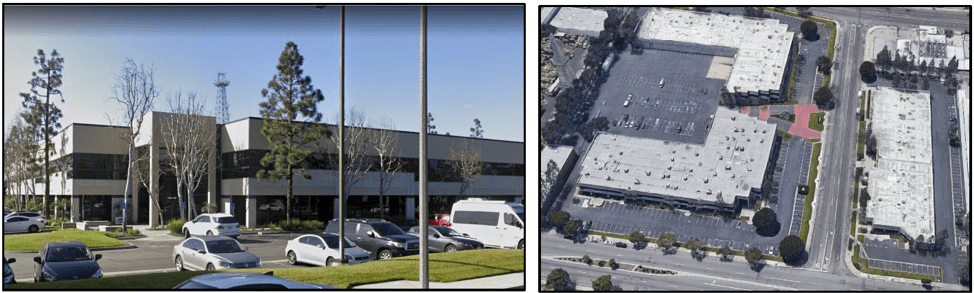

184,000 SF Flex Industrial Asset – Carson, CA

In early 2021, Granite Peak negotiated the off-market sale of a 184,040 square foot office (60%) and industrial property (40%) located in the Carson, CA market. Consisting of three properties, the investment provided Granite Peak’s client with the rare opportunity to acquire infill high finish industrial product in the South Bay area of Los Angeles, one of the most highly desired industrial markets in the country. Beginning in early 2020, industrial land values in the South Bay submarket surpassed land values for office properties for the first time, driven even higher by the explosive growth of e-commerce during the COVID-19 pandemic. These dynamics in the submarket created a unique opportunity for ownership to capitalize on the Carson property’s underlying land value for future redevelopment into industrial use.

Given that the property was 95% occupied at the time, the opportunity to sell the property at extremely high land prices initially seemed limited by long-term leases on the properties, which would likely prevent redevelopment until 2027 or later. After receiving two unsolicited offers to purchase two of the three buildings, Granite Peak ran a “Best and Final Offers” process with these buyers and a select group of other logical buyers that incorporated transaction parameters outlined by the client. These transaction guidelines were met in full by a leading institutional industrial real estate owner, which included an all-cash purchase for all three buildings, a short due diligence period with a long escrow to ensure a successful 1031 exchange for the client, as well as the transfer of all lease expirations and buyout risks to the buyer without any contingencies.

Since the initial investment in 2005, the Carson property generated a 10% average annual return on investment over 16 years. The combination of exchanging out of the Carson property at a 3.5% cap rate and into Quattro at a 7.0% cap rate and sub-3% interest-only payments resulted in a tripling of the cash flow on the client’s equity.

Conclusion

The COVID-19 pandemic created unprecedented challenges for all businesses across every industry. The real estate industry was no exception, and many of the challenges will persist for years to come. Granite Peak’s approach to creating and preserving wealth over the long term allows our clients and investors to capitalize on opportunities across asset classes and markets, as well through the different stages of the real estate cycle. The Granite Peak team’s owner-operator mentality informs every decision we make and ensures an unwavering focus on current and future value creation, income optimization, and capital preservation across each client portfolio. While we will continue to face unforeseen headwinds and challenges, we remain focused on enabling our clients to benefit from direct real estate ownership through the strength of our team’s experience.

Granite Peak remains focused on creating value and preserving wealth through actively managed real estate investments – from strategy to execution. Our customized solutions enable our clients the ability to maintain control and timing of all ownership decisions, such as acquisition, capital structure, financing, leasing, management, and disposition decisions. As a trusted real estate advisor, Granite Peak’s services are tailored to provide each client the ability to build real estate portfolios that meet their specific needs over the long term. We approach every decision with an owner’s mindset, driven by a shared-gains model combining institutional-quality execution with an entrepreneurial spirit.